In today’s startup ecosystem, there’s an alarming trend: too many successful founders are stepping away from building companies and moving to finance.

For many it’s the logical next step. The “path” successful entrepreneurs must go on to evolve or elevate to the next level. Start in a startup. Build your own startup. Sell your startup. Then finally become a venture capitalist to leverage your experience for greater returns.

Especially for exited founders, it seems the only natural next step is to become advisors, investors, or VCs. But here’s the problem…

When experienced founders leave the trenches, we lose too much critical skills and experience that could fuel the next wave of startups.

Battle hardened founders move from building startups to sharing advice or signing checks, and the startup founder learning curve gets reset, instead of compounded by these leaders not starting more companies.

Instead of continuing to build, too many seasoned entrepreneurs become spectators, guiding from the sidelines rather than playing the game.

It’s not just an issue of losing talent—it’s a massive waste of the hard-earned lessons learned on the frontlines of founding, scaling, and exiting a company.

The Cost of Losing Founders to Finance

The startup world is losing some of its most valuable assets—founders who’ve navigated the grind of building a company.

These are the very people who should be leveraging their battle scars and experience to create new ventures. Instead, they’re opting for a career in finance, thinking it’s the logical path of progression. Why?

Is it because the industry is overly focused on the myth that the ultimate success for founders is to transition into venture capital. Too many founders I meet say this all the time, “If I sell this company, I’ll probably become a VC.” Why? “Because that’s what people do” is 80% of the answers.

This mindset is flawed. Moving from founder to VC may seem like a logical progression, but it often means stepping away from the creativity, risk-taking, and operational involvement that made these entrepreneurs great in the first place. The learning curve of building companies is being underutilized—and in some cases, lost entirely.

Founders who become investors often find themselves further removed from the grit and hustle of the startup ecosystem. They advise but rarely operate. They invest but don’t build. And this disconnection can mean their hands-on experience fades over time—often leading to more frustration.

I certainly had this feeling—given advice that was not taken. It’s a strange loss of agency. It’s also not your company so there’s no reason people have to listen, or take action.

In some ways I get it. Founding companies is hard. It’s a thankless task building a business. It’s lonely. The founder’s journey is not the hero’s journey in reality. Burn out, fatigue, loss of relationships, friends and family is real. Why would anyone want to do that again, and again.

Yet I believe there is another way, at least one that spoke to me.

The Rise of Venture Studios: A Solution to Founder Exodus

One of the reasons I found venture studios are so compelling is that they allow founders to stay engaged in the act of creation. Venture studios offer a unique model where you don’t have to choose between being an operator or an investor—you can be both.

As a founder within a studio, you can continue to create new companies while leveraging your experience across multiple ventures. You’re still in the game, still hands-on, but you have the added advantage of spreading your energy and expertise across a portfolio of startups, building equity in each.

At Nobody Studios our leadership team consists of a group of 16+ people with over $15 billion in exits, 75+ startups between us, all still building, in the struggle yet learning and growing.

Redesign Health another venture studio focused on building healthcare startups. Since its founding in 2018, it has created over 40 companies, with notable ventures in areas like behavioral health, chronic care management, and alternative medicine. Some of its portfolio companies include Calibrate, a metabolic health platform, Springtide, an autism care provider, and Uplift, a behavioral health service that connects patients with in-network therapists. Redesign Health itself achieved a $1.7 billion valuation as of 2022, reflecting the significant value generated by its model of launching and scaling healthcare startups efficiently.

The studio model attracts founders who have previously exited their companies. As with Nobody, Redesign’s structure provides them with the resources, expertise, and connections to create new ventures, making it appealing for serial entrepreneurs. These founders often return to work with the company due to its supportive environment and access to healthcare industry experts and capital. This focus on collaboration and repeated engagement with successful founders has been a key part of its growth strategy.

Redesign Health, Nobody and a suite of other venture studios are attracting experienced founders who are tired of the “exit-to-VC” pipeline. Studios offer an environment where founders can actively build companies while also holding equity in many ventures.

It’s a best-of-both-worlds scenario: staying involved as a founder and operator while gaining the benefits of being an investor. The entrepreneurial and founder experience is not lost—it’s reinvested into building even more.

Data and Examples: The Power of Serial Founders

We’ve seen this trend play out with multiple high-profile entrepreneurs. Founders of companies like PayPal helped to seed Tesla to YouTube, Yelp and LinkedIn. What if they all kept going after each breakout business beyond Musk?

The value their startups created is undeniable—PayPal revolutionized online payments, LinkedIn transformed professional networking, and YouTube reshaped social media.

But imagine if these founders had continued to build new ventures. How many more transformative companies could have been created?

The PayPal Mafia is often cited as a success story of founders turning to investment, but it’s also an example of lost potential. Yes, many became influential VCs, but how many could have built another PayPal, LinkedIn or YouTube?

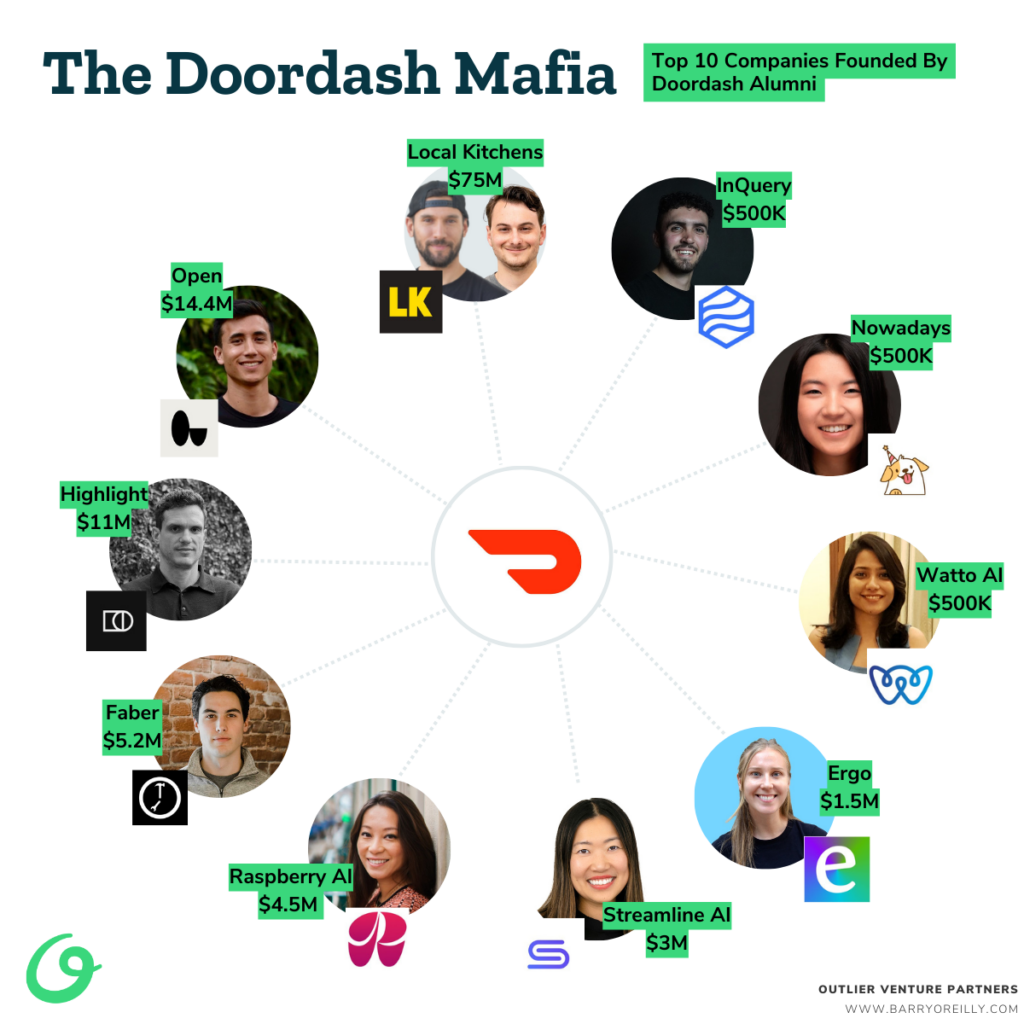

DoorDash is another early example of founders, creating more founders, and continuing to build businesses too.

The lessons they learned scaling that business are invaluable—and yet, much of that knowledge is now used to advise from the sidelines.

The Path Forward: Founders Should Keep Building

We need to challenge the assumption that the only growth path for successful founders is to move into finance. Instead, founders should stay at the forefront of innovation, continuing to build, operate, and invest in their teams.

Venture studios offer one compelling way to do this, but founders don’t have to limit themselves to existing structures—they can create their own vehicles for innovation, shaping the future of multiple companies without stepping away from hands-on leadership.

Multiple-time founders are increasingly waking up to this idea. They are realizing that their expertise is more valuable when actively put to work in building companies rather than advising them from the outside. And as more serial founders embrace this model, the startup world will benefit from their continued involvement.

Conclusion: We Need More Builders, Not More Bankers

We can’t afford to lose more founders to finance. The skills, energy, and experience that come from building companies need to stay within the ecosystem.

Whether through venture studios or founder-led vehicles, it’s time for successful entrepreneurs to realize their potential as operators and investors in multiple ventures.

The next wave of billion-dollar companies won’t come from the sidelines—they’ll come from founders who keep building. Even Marc Andreessen of a16z reminded us, It’s Time To Build.

Let’s encourage founders to keep creating, leading, and transforming industries by creating new and interesting ways to make startups succeed.

Because when we lose founders to finance, we’re not just losing entrepreneurs—we’re losing too much of the learning curve for the future of innovation.