Precision Product Creation: Generating The Right Offer At The Right Time By Creating Your Information Portfolio

For decades, a frustration has been growing among executives, entrepreneurs, and teams who wish to make better decisions and create breakthrough innovations. They all struggle with how to produce the right product at the right moment—the mythical point of convergence between customer need, technology trends, and internal capabilities.

Most companies continue to rely on outdated models, measures, and methods of portfolio management, causing them to waste money, miss opportunities, and lose market share. But a new realm of possibility is emerging.

The key to limitless success in business is the ability to bring forward the right product at the right time for the right people—perfect information and perfect action. This capability is now more accessible, granular, real-time, and insightful than ever, through data management and artificial intelligence.

In this article, we’ll show how product development is less about developing products and more about developing knowledge about the product.

We’ll demonstrate why companies should shift their focus from product portfolios to an information portfolio and how to stop wondering what you should do with the data you have, and start deciding what data you need and figure out how to get it.

Article highlights:

Why companies must shift their focus away from product portfolios to an information portfolio

How the prevailing approach to portfolio management is outdated and inhibits breakthrough innovation

How to recognize when your internal capabilities, industry trends, and customer needs align for best results

5 case studies from connected companies leveraging information portfolios as a competitive advantage to drive for future growth

What steps you must take to start building your information portfolio and data collection capabilities

Most companies are using outdated models, measures, and methods of portfolio management, causing them to waste money, miss opportunities, and lose market share.

But a new realm of possibility is emerging. With the rise of data and machine learning—the Data-and-AI Paradigm—we finally have the tools for a Connected Company through Information Portfolio Management.

Finnish legend tells of a magical device called the Sampo that gave its possessor riches and good fortune. Unfortunately, this device was stolen and then destroyed or lost.

Many cultures have had similar concepts, such as the Greek cornucopia, but this has all been the stuff of myth…until now.

The most valuable substance in the world is not money, jewels, oil, or even bitcoin. It’s information. And we now have within our possession the tools to make truly meaningful use of it.

The key to limitless success in business is the ability to bring forward the right product at the right time for the right people—a convergence of perfect information and perfect action.

And this capability is more accessible, granular, real- time, and insightful than ever, through data management and AI.

To capture the full value of this new opportunity…

A well structured data capability enables a much more successful product suite. It’s the modern equivalent of the legendary Sampo, and no company should be without one.

For decades, a frustration has been growing among executives, entrepreneurs, and teams who wish to make better decisions and create breakthrough innovations.

They all struggle with how to produce the right product at the right moment—the mythical point of convergence between customer need, technology trends, and internal capabilities.

It requires perfect information encapsulated and perfect action executed, and even those who achieve this sublime state in one instance find it difficult to repeat.

Companies are spending a fortune on digital transformation efforts, but how do they know these are good investments? They don’t.

IDC reported that, “Direct digital transformation investment is growing at a compound annual growth rate (CAGR) of 18% from 2020 to 2023 and is expected to approach $7 trillion as companies build on existing strategies and investments, becoming digital-at-scale future enterprises.”

To put that in perspective, total US expenditure on healthcare for 2020 was estimated at about $4 trillion.

70% of those transformations fail, most often due to resistance from employees. Only 16% of employees said their company’s digital transformations have improved performance and are sustainable in the long term.

Endless articles and authors have pitched the power of strong innovation portfolio management as the key to success: diversifying risk, making bets, and measuring outcomes to gain reward in the face of uncertainty.

But the truth is the approaches that many experts advocate and implement are outdated—they’re manually created and tracked, and they’re gleaned from poor- quality data.

At a more fundamental level, terms like “business value” are both overused and oversimplified as guiding principles for prioritization. Value is often equated to dollar digits—a weak lagging indicator—or simply not defined at all.

When we ask leaders about their systems— how they fund, start, stop, pivot, preserve, and pause innovation initiatives—the answers vary wildly. Project management officers want consistency; product managers want customization and control.

Conflicting measurements and control processes mean the majority of leaders have no idea what’s really going on within or outside their company.

One c-suite executive related to Barry that his company had nearly 200,000 employees, yet his best figures estimated that for what they were trying to accomplish, they shouldn’t need more than a third that number. He half-joked, “I have no idea what 60% of our employees are working on!”

But this lack of clarity is not surprising, because until recently, it’s been very difficult to obtain.

Tuomas shares that in Futurice, with just 650 people across Europe in a bottom-up organizational culture, it was a struggle to understand what was happening in the portfolio. This is one of the main reasons why the company started building an information portfolio—to enable continuous insight into internal activities and knowledge development.

The good news is the technology and understanding are now available for companies to achieve strong, useful, real-time data capabilities. But before we can fix what’s broken, we need to understand what the current problems are. Technology alone can’t solve the issues—we have to rethink our investment priorities.

How Portfolio Management Is Broken

These are the top portfolio problems we (and many of our colleagues) encounter in large companies…

Overpromise, overinvest, crash-and- burn in two years

Teams feel the need to overpromise business growth in short time frames, like two years or two funding cycles. They’re anxious to get the attention and funding needed to bring their bold pitch to life before something better grabs their boss’s attention and budget.

This forces teams to invest heavily from the outset in order to appear credible in reaching the promises and avoid losing their funds. High upfront investments and low market maturity and uptake often result in major disappointment and initiative cancellation. This is chalked up to failure of execution or a poorly pitched plan.

Lack of consolidated internal view

No one has a clear view of what is actually happening inside their company: what capabilities exist, the gaps to be addressed, and the opportunities to be leveraged when the perfect moment arises.

They build and hope. They dress up their actions in fancy terminology—strategic, disruptive, even genius—to hide the truth no one wants to admit. When they hit on a successful idea, it’s largely because luck or favorable but inexplicable circumstances have converged.

Lack of consolidated portfolio progress transparency

Most companies are still measuring progress as output—the completion of work—without tracking (or even establishing) meaningful outcomes for the customer and the business. And even if they understand the progress, they’re left wondering how much the results are due to their actions and how much is due to market maturity.

Lack of consolidated view externally

Companies lack a consolidated, up-to-date view of external factors that could affect their business or industry. Their information about market changes and client needs is often either 1) sporadic, anecdotal, and intuitive or 2) holistic but outdated. They miss key indicators and changing circumstances like new trends and competitors, and they fail to adapt.

Timing of investments

Visionary companies (over)invest into new opportunities too early, resulting in failure and erroneously writing off the idea. The timing challenge arises from both market & technical maturity: sometimes the market is not ready, and sometimes the market is ready but the technology is not. Balancing on the fine line between too early and too late at each step is one of the most challenging aspects of innovation portfolio management.

Data capture is an afterthought

Data is often the last thing teams consider in portfolio management. They bring a product to market without even knowing what results they’re aiming for or what data they should monitor, let alone having already built such tracking capabilities.

All of the above result in a lack of feedback loops that could continuously optimize the complex portfolio.

We can therefore say that standard portfolio management is disconnected—from markets, from internal activities, and from historical learnings. Companies are managing highly dynamic systemic phenomena with insufficient data and inefficient, process-execution-driven tools.

“Getting a handle on your innovation portfolio can be challenging. For example, AT&T realized it had multiple operating system research projects in its laboratories. It had already invented Unix, which was rapidly becoming one of the world’s most important operating systems. Would AT&T be able to benefit from inventing more new operating systems?”

Companies need to start reorienting themselves, not around the products they’re building, but the way that they’re gathering and synthesizing data to inform what products they should be building.

Technology has reached a point now that we can get much higher-quality data much more quickly. But this represents a paradigm shift, which means that the existing language and definitions of portfolio management need to be updated.

Rethinking Portfolio Management Starts With Redefining “Value”

The first definition to redefine is “value” itself. When most people talk about value, they mean money. But money is the result of a great information strategy: perfect information enables better decision-making on the right offering and timely corrective measures to the right customers and markets at the right time. In other words, perfect information results in a perfect business.

Traditionally, organizations have invested in physical assets with an intention to turn them into money in the future. Buildings and machinery are considered of value and go on the balance sheet. Intellectual property, such as patents, are also seen as assets.

But quality information is much more valuable than patents of ideas. Companies are trying to lock up their IP in a patent while ignoring the capability to sense in real time what information is actually valuable and respond to it.

The tools provided to most product teams are just for tracking their own work so managers can report on outputs and enforce compliance with processes.

Meanwhile those teams lack tools to discover how customers are using the products

—the insights that would actually help them make their outputs meaningful and successful.

Another common error is that data teams gather certain data, but then can’t answer any questions to help the organization. Instead, they should start with the important questions for their organization, then find the data and build the tools to be able to provide the answers.

The Data-and-AI Paradigm is not about data warehouses or analytics platforms, but customized tools that help you run your business based on the unique problems it faces. These systems should be built and should be in the balance sheet as an asset.

Think of your information portfolio as a factory that can turn out great insights. Then, based on those insights, you can determine which products to avoid, which to build, and when to build them. Real-time data streams provide sustainable value.

Information portfolio management is not about looking at what data you have and wondering what to do with it. It’s about deciding what data you need and figuring out how to get it.

The emergence of information portfolios is making many traditional strategy frameworks obsolete. Information portfolios offer a new dimension

where companies can build competitive advantage. Early movers, especially in the consumer business like Unilever, Amazon and Google, are already doing this and there are visible signs of the realized benefits. In other sectors, the leaders are also heading into this direction like we at KONE.

The Promise of Information Portfolio Management

The data driven approach enables us to rethink portfolio management altogether, shifting from a product portfolio to an information portfolio. The speed of insight and the resulting level of adaptability available to companies today is unprecedented. We can continuously turn data into the right products and services for the right customers at the right time.

This information-focused approach is already well established in the area of investing. It’s now commonplace to tap into real-time data sources such as satellite imagery, harbour volumes, and news sentiment to inform investment, sales, or short positions. In fact, an investment company today who’s not doing this would likely be laughed out of the industry.

Yet in the area of enterprise portfolio management, this type of strategy—and the system to support it—so far remains almost non-existent.

Of course, the traditional paradigm has included market research, product

validation, and minimum viable products. But these processes have typically been approached sequentially, as discrete phases with beginnings and endings. The result is that the information gathered along the way is outdated and virtually meaningless by the time the product gets to market.

In the Data-and-AI Paradigm, companies are able to conduct “market research” continuously through real-time data streams, in parallel with continuous product development. The technology enables powerful feedback loops that drive product creation with data-driven insights.

When you continually monitor activity in the market and connect that to your internal information portfolio, research becomes no longer an activity per se, but a part of the process of investment decisions and product development.

Rethinking Funding and the Pace of Product Development

One of the interesting transformations this paradigm brings about is a reimagining of the culture of how ideas are funded in large companies.

How many projects have you been on where the lead asked for less money than was offered to test an idea before building it out? Or decided to return a portion of the budget because they weren’t ready to use it? It never happens, because in most organizations, neither the process nor the culture support it.

Large enterprises typically either increase investment in a project or kill it. The idea of scaling product development up and down to adapt is completely foreign. Everybody is fighting over resources: “Small” means “not valuable,” and “failure” or “budget cuts” constitute a loss of face for the individuals in charge. A person’s value is literally measured by the size of their team and budget.

Companies need a new context for funding projects. We find a useful analog in cloud computing—companies can increase or decrease server capacity based on customer demand. That’s possible because of readily available data insights into how many people are using their service.

A similar approach can be taken with products and services by continuously gauging demand in the market. If you have adequate information systems in place, you can scale up or down as you receive that data in real time.

Without data, no one knows what the best ideas or solutions are. But with an information portfolio guiding the way, the role of leaders and managers can switch from “all-seeing oracle” to well-informed guide on a journey of discovery, free from the pressure to bet big on being right. It’s “right” in the data!

Futurice puts this into practice itself by pacing the development of its Connected Company program in accordance with the feedback it’s getting. This program is designed to help growing organizations reconnect people to knowledge and activity to impact, enabling strategy feedback and creating alignment and flow efficiency.

Connecting internal flows of information empower results that seem almost magical, and the concept has proven both highly valuable internally and inspiring for potential clients. However, only the most forward-thinking companies are willing and able to engage with this program at this early stage, so it’s not ready for scaling.

The Futurice team continues to monitor the data, develop client relationships, and adjust its strategy accordingly. A big buildout at this time would be unwise, but killing the program would be unthinkable given the proof already collected. And no one is losing face. It’s just part of the process.

How Organizations Are Winning With Information Portfolios

Recognizing the convergence of internal capabilities, industry trends, and customer needs allows organizations to align and execute initiatives for best results. An effective information strategy includes evaluating which information offers the most value, determining how to acquire it, and investing as needed to build the desired visibility.

The point is not to automate decision-making about your portfolio but to inform decisions with a broad set of insightful information.

The maturity of data, cloud computing, and machine learning in the AI Paradigm is making these capabilities more accessible than ever. Let’s look at some cases of how to inform product, service, and offering decisions based on a Data-and-AI-powered information strategy.

Lipton Matcha: Tapping into existing market opportunities via data

Lipton decided to improve their tea offering in an unconventional way: by analyzing, together with their partners, millions of tea-related social media conversations. They identified that the most interesting rising trend was related to matcha, a Japanese green tea powder. Lipton acted upon the insight and generated a category-leading product in just five months. (It also launched a vegan version of Magnum ice cream because of questions received by customer service.)

Coca-Cola Freestyle: Investing into client insight

When lacking visibility into what clients want, you can extend your portfolio by bringing your customers in as creators. One option is to build dual-purpose products that satisfy a known customer need while also providing insights.

Coca-Cola Freestyle machines allow customers to mix their own soft drink. This service is appreciated by consumers, and the data coming from Freestyle machines allows Coca-Cola to create an information asset that empowers them to release offerings that already have proven market acceptance.

This strategy shifts product development ideation from an internal process to one that actually lets the market create products for them.

Global Fishing Watch: Fighting illegal fishing with data

Global Fishing Watch, an independent, international non-profit, is using the information portfolio concept to successfully combat illegal fishing with precision data. They combine publically available shipping and GPS data with satellite imagery, and they teach AI to recognize fishing vessels whose tracking beacons are switched off.

They put all the vessels on a map, giving local authorities the means to find illegal fishing boats. Videos show how in a couple of months, they got rid of illegal fishing in many countries just by managing an information portfolio.

QuantIP: Informing decisions about capability building

Executives talk a lot about building capability, and for good reason.

Companies need to know which trends to follow. A current example of what happens when you don’t— automotive companies failed to invest in electric drive capabilities. Now Tesla’s value is more than the next five companies combined (even though Elon Musk has stated it’s overvalued). QuantIP is a company that is providing capability building for information management. They analyze trends and landscapes, and they can even analyze the quality of a company’s patents. So companies can measure how their intellectual property and innovations are developing against the competition.

Shape Activities to Emphasize Data Over Processes and Feedback Loops Over Output

Most companies today are at best thinking about product outcomes, and many remain fixated only on output metrics (shipping features).

Collecting customer usage data is generally an afterthought, not a critical process to inform organizational decisions.

Companies identify something they want to build, create the plan (how long it will take), and invest in a big build and big-bang launch. They measure success in terms of delivery.

Only after the product is in the market do they start asking, “What impact is this having?” They realize they don’t even know what they want to measure, let alone have the analytics capability to capture the data and tell them if it’s having the impact they want.

Amazon and Google, on the other hand, have been putting data first for years. They’re winning because they design their products to not only capture data, but to label and structure that data in a way that other products and parts of the business can leverage for decision making, adaptation, and new innovations.

All the information coming in through their products is structured and labeled in a way that other teams can leverage it. So Google Maps and Gmail share data and insights. Alexa and Amazon.com share what they know about you.

And both companies create systems to gain access to third-party data as well. Amazon provides customers inexpensive devices like the Echo that give them a sensor in people’s homes. It also observes what products sold by its third-party sellers are favored by consumers, then builds its own competing products (not necessarily fair, but effective).

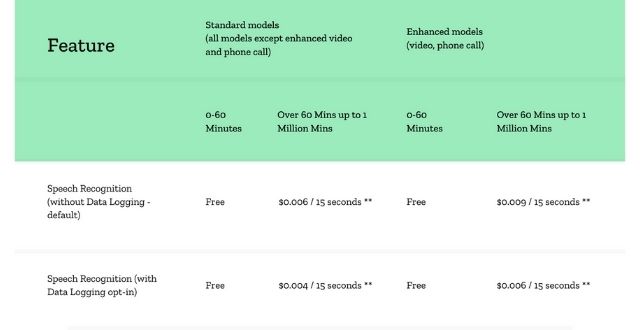

Google’s transcription service pricing is dependent on whether you give the company access to your data or not (you pay 50% more if you opt out).

It’s time for forward-thinking companies to move beyond valueless customer-usage surveys and start using the amazing technology we have today. To win in the market, you must consider what information you need to gather at each stage of the process or product you’re creating.

Not only can Information Portfolio Management result in better and more successful products, but the primary use-case for data streams often creates insights valuable for other processes.

For example, Futurice ran a pilot program, creating a knowledge search engine to help alleviate the challenges customers faced when calling a large personal-service provider. Secondarily, by seeing what people were asking, the company could better understand the demand and thus start improving workforce planning, such as which kind of providers should be available, and when. It also started rethinking portfolio management, and even flow-efficiency-based dynamic operational control, using the continuous stream of fresh insights.

To get the full value from data streams, create a mechanism for reinforcing learning about the product you’re building and connecting insights back to portfolio concerns. This should include a plan for making the information and learnings available to other platforms, products, and services. This is the essence of Information Portfolio Management.

How To Start Building Your Information Portfolio

The best way to begin developing an information portfolio is simply to make the decision to prioritize both internal business data and external market data based on the most important questions you want to answer in your portfolio.

You can start small with off-the-shelf solutions. There are many existing solutions, including comprehensive toolboxes from Amazon, Google, and Microsoft, and focused tools such as Aito.ai, MindsDB, H2O AutoML. You can also find companies providing external data from an array of sources, such as RavenPack and Eagle Alpha. Even everyday tools can offer surprising capabilities, for example Microsoft Excel can enable sentiment analysis using Microsoft tools.

Important! Don’t worry about having perfect data at the outset—start with what you have. You can glean many insights through proxy data and alternative data sources. Even tools as commonplace as Google

Trends can be transformative for organizations stuck using their own limited and outdated data sets.

Here are the essential steps to follow:

- Identify problems in your information portfolio worth solving by quantifying the value of the missing data.

- Evaluate the feasibility of solving the problems.

- Prioritize according to high-value and high-feasibility.

- Obtain some of the missing data and see what it takes to do so.

- Work in cross-functional teams.

- Build an first MVP with static data—it will be out of date, but it gets the system going and is a much less expensive way to test the data value.

- If it proves valuable, build the streams for real-time data.

Start with available third-party tools, and build your own data capabilities for the long term, especially in the realm of data pipelines. What’s most important is getting started. When you do, you’ll be amazed at how much and how quickly you learn.

Keep in mind the privacy implications and responsibilities of collecting and possessing more data. Build your “My Data” practices. How will you protect the rights of the individual using your product so they’re aware of what information you’re gathering and how it will be used? With growing public concern about privacy rights and data commoditization, the more transparency you can provide, the more trust customers will have in you.