Funding the future is becoming far different and much better than anything creators, entrepreneurs, and investors have had access to before. Exciting new ways to back what you believe in have arrived—and are spreading fast—enabling anyone to become a venture investor, fund innovative new businesses, and own a piece of the pie from the beginning.

In the past, if you wanted to start a business, getting access to capital was one of the hardest parts, but not anymore! These new funding mechanisms are empowering creators, lowering barriers to entry, and leading to an explosion of entrepreneurialism.

To understand the significance of this revolutionary transformation, let’s take a look at how we got where we are today in venture funding and company building, what lies ahead, and how you can become a part of the movement.

A Very Brief History of Venture Funding

In the past, banks were the go-to resource for entrepreneurs seeking capital for new ventures. Applying for a loan meant preparing a 500-page business plan, putting on your best suit (or borrowing one), and rehearsing your most convincing “I’m a serious business person” story.

If you were doing anything new or remotely innovative, the bank loan officer’s likelihood of understanding it, let alone funding it, was low. Even worse, if you didn’t look, act, or sound like them, your chances were almost non-existent.

Too many entrepreneurs and businesses have been blocked (and still are) because of this lack of access to capital—and not just small or early-stage companies, but every type.

The Rise of Venture Capital

Frustration with the onerous system and overall disillusionment with banks gave rise to venture capital. Successful entrepreneurs wanted to support other founders and invest in new ideas, so they started funding them. As venture investors, they would take on risks that banks wouldn’t, energize entrepreneurs, and see more of the upside. They had a better understanding of the domain and what it took to be successful, and they were willing to bet on the future they believed in.

The VC world has funded a tremendous amount of innovation over many decades. However, it has had its own downsides and limitations. One is that it has always been perceived as a closed community, exclusive and focused around companies within just a few zip codes. The reason San Francisco, for example, has so many startups is because there are so many venture capitalists based there.

The system has become even less accessible in recent years, as a tidal wave of institutional money has flooded into early-stage companies. Valuations have skyrocketed, making new venture funding increasingly expensive, risky, and difficult even for experienced VCs to find good deals, let alone the average investor.

To give you some perspective, ten years ago, $1 million would have been on the high end for a series A funding round. Today, it’s $10 million minimum, and 2021 saw the first-ever $100 million Series A!

Meanwhile, the majority of people have been locked out of this wealth creation system, stuck with the banks, and maybe a single-digit return on their mutual fund if they’re lucky…until now.

As the internet has given rise to digital peer-to-peer interactions and transactions, new possibilities have emerged for funding innovation and investing. These open the playing field for both entrepreneurs and individuals wanting to invest in new ideas and bold businesses. Now everyone can have a real shot at building wealth.

The Rise of Community-Based Funding

In the last couple of decades, and especially the last few years, changes in technology, regulations, and culture have empowered creators to get funding directly from communities that care deeply about what they’re doing.

It started with crowdfunding in the late ‘90s and is now evolving into a collaborative, technology-led movement.

In the emerging paradigm known as Web3, anyone can start, join, and contribute to new businesses or creative communities they believe in. They can have ownership and thus see rewards. These decentralized autonomous organizations (DAOs) define their rules as a computer program that is transparent and controlled by the organization members with decision-making distributed.

This community-based model is rapidly gaining momentum to challenge—and perhaps ultimately replace—the traditional hierarchical model of venture building and funding. However, at the moment, this movement is so bleeding edge that it’s difficult for many people to understand or engage with.

The good news is there’s a more familiar stepping stone for you to get started as a venture investor, take part, fund, and own a piece of the future. It’s an exciting innovation that values similar community-based principles, yet is much easier to access and understand. It’s called equity crowdfunding.

Leveraging Crowdfunding as An Investment Engine

Crowdfunding was the first step in the disintermediation of the old capital systems, lowering barriers to entry and letting communities fund ideas they believe in.

Early crowdfunding sites let you contribute to causes or pre-purchase products you wanted to own and see in the world. Yet while you could help these companies get started or expand, you couldn’t own a piece of the company itself.

Roughly one-in-five Americans (22%) report that they’ve contributed to an online fundraising project on a website like Kickstarter or GoFundMe. These crowdfunding contributions have mainly gone to individuals, charities, special events, and artistic projects.

It’s a wonderful mechanism for sharing resources, supporting people, and helping bring ideas to life, but it hasn’t been a wealth-creation tool for those providing funds. Backers haven’t been able to use it to invest in an early-stage company and own a stake.

Enter Equity Crowdfunding

For Americans, that began to change in 2016 when the SEC completed implementation of Title III of the JOBS Act, which legalized equity crowdfunding (a.k.a. regulation crowdfunding). This landmark rule change had two major components:

- It opened the door for private companies to use crowdfunding to offer and sell securities to the general public.

- It allowed non-accredited investors (people with a net worth under $1 million) to contribute to these companies.

Equity crowdfunding offers an incredible wealth-creation opportunity where anyone can participate and get ownership in early-stage companies—yet almost no one knows about it.

The overall crowdfunding market is projected to grow to $300 billion by 2030, but 36% of people still aren’t familiar with it. And of those who know about crowdfunding, the vast majority don’t see it as an investment opportunity.

Why is this mechanism so impactful?

- Decentralization

Entrepreneurs no longer have to rely on banks or VCs for capital. They can fund not just an idea or a product but a whole company from the crowd. - Democratization

Everyone now has access to the powerful wealth-building opportunities inherent in new venture investing. It puts more power into people’s hands and starts to level the playing field by giving access to this investment vehicle. - Greater creator and community ownership

People put more energy behind entrepreneurial endeavors in which they have equity. Equity crowdfunding means the creator and the community can own more of what they build together. They don’t have to hand over the majority of the company to bankers to get their ideas off the ground.

While equity crowdfunding can still only be done through a few accredited platforms such as StartEngine and Republic; it goes a long way toward bringing everyday investors and entrepreneurial enterprises together.

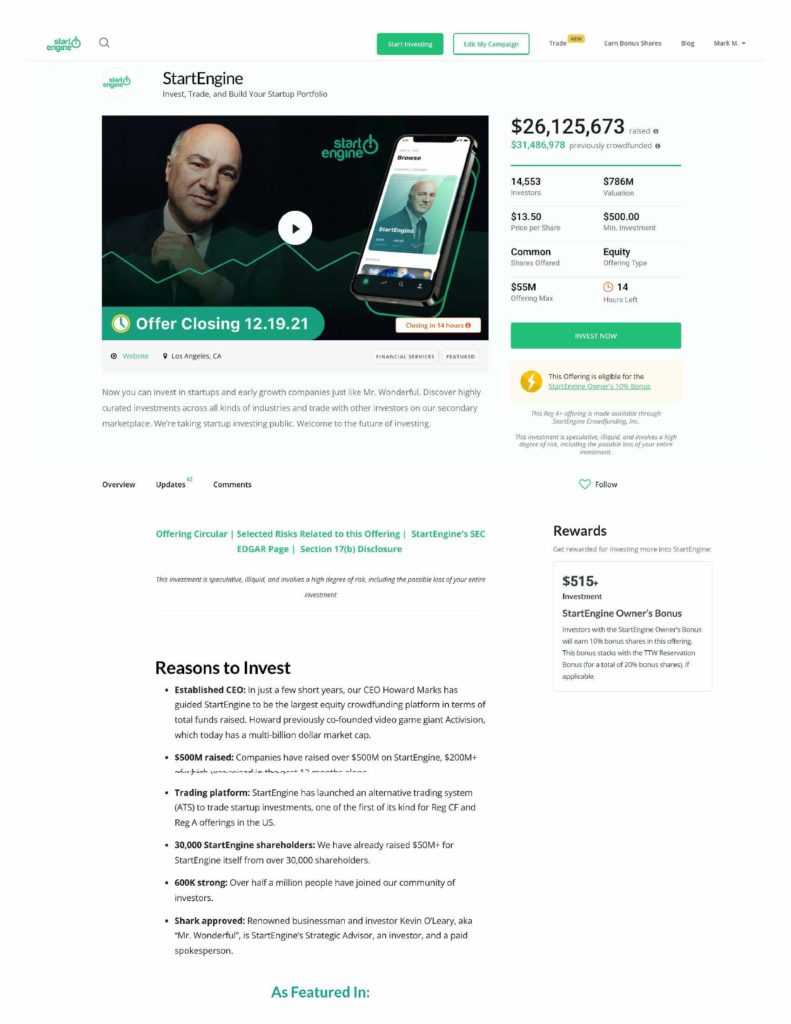

A great example for understanding equity crowdfunding is StartEngine itself, which uses its own platform to raise funds from its community. It recently completed a new raise of $28 million and reached a valuation of nearly $800 million (up from $60 million in June 2018). It has a stated goal of helping early-stage companies raise over $10 billion by 2029.

Now is the perfect time to get involved in this fantastic innovation and participate in the emerging, democratized future. And here’s how…

Nobody Studios, the high-speed, Crowd Infused™ venture studio I co-founded last year will soon be launching our own equity crowdfunding campaign. We believe we’ll be the first venture studio to do so, and this brings investors several unique and powerful benefits:

- ownership not just in one business, but an array of de-risked, highly innovative companies (our bold mission is to build 100 compelling companies in 5 years!)

- automatic diversification from the beginning with a single contribution

- minimum investment that’s affordable to almost anyone

- upside for every successful company we create, forever!

This is your chance to be an investor in the better future we’re creating across health and wellness, creator communities, democratized marketplaces, and support services for specific populations like parents and veterans—and much more!

To join the waiting list, email: [email protected]

Here’s to a bright 2022 and a democratized future,

Barry